So, Dmytro, tell me more about your company. How did you come up with the idea of Alcor?”

Dmytro: “My journey in tech started at a huge IT services company, Luxoft, where I was a Head of Legal Services. I really liked what we did there – providing access to brilliant tech talent from Ukraine for innovative companies abroad. But what didn’t seem right to me was essentially this entire concept of “leasing” developers and paying them through an intermediary with cloudy pricing.

So, I set out to build something different – a solution that would allow hi-tech companies not just to tap into foreign talent but to turn it into their strategic asset by setting up their own development teams, with fully transparent pricing and zero buyouts. My idea resonated with a few colleagues at Luxoft, and together we started what’s now Alcor.”

Nadiia: “I’d like to hear more about your solution and what sets it apart.”

Dmytro: “I assume you’ve probably heard of the Employer of Record (EOR). Basically, this is a model in which a provider with a local legal entity handles the legal and administrative aspects of talent hiring, while the client handles product and team management. That was the backbone of our solution.

But the EOR on its own lacked some essentials, like tech recruitment and operational support, something I noticed many expanding hi-tech companies were struggling with. So, I decided to combine all these three components into one à la carte solution – software R&D center.”

Nadiia: “That sounds truly novel. So, how exactly does your model work?”

Dmytro: “It all starts with tech recruitment. Our team prepares tailored reports on talent availability and salary benchmarks, as well as blind CVs for selected locations. Then we devise a hiring strategy, craft ideal candidate profiles, and EVP.

After sourcing and pre-screening, we handle interviews to evaluate candidates’ soft skills, cultural fit, and English proficiency, and if required, a tech expertise assessment. The entire process of closing one tech vacancy lasts about 2-6 weeks.

Once the client approves a candidate and the offer is accepted, our EOR engine sets in motion. We collect the necessary developers’ data, draft tailored contracts (FTE or B2B) and NDAs, and set up payroll, benefits, and compliance records. The onboarding process takes no more than 10 business days.

On request, our clients receive additional operational services, including equipment procurement, office leasing, visa support, employer branding, stock options, and more.”

Nadiia: “And do you have a centralized management platform like those big-name companies – Deel, Remote, and G-P?”

Dmytro: “Yes, our cloud platform is called AlcorOS, and it was actually built on our clients' feedback, so it’s completely functional and user-friendly. It allows tracking hiring progress and team size, managing expenses, benefits, and PTO, viewing payroll history, and monitoring equipment and assets – all the essentials in one place.

Unlike the big names you mentioned, we don’t focus solely on automation. We combine it with dedicated, human support via our Customer Operations Managers. They ensure prompt, proactive, and professional support via email and phone, giving our clients confidence that they’re never alone with their issues. In fact, the lack of reliable, direct contact, especially for urgent matters, is one of the most common reasons companies switch from their EOR providers to Alcor."

Nadiia: “This automation-plus-human-touch approach sounds smart. And what about your pricing?”

Dmytro: “So, as I mentioned earlier, it was really important for me to make it fair and transparent. In IT outsourcing, when a tech company pays, say, $100, the programmer receives only half of the sum. The other half goes toward a vendor fee and hidden costs, mostly to cover developers on the bench. I wanted to change that. I wanted to provide workers with better wages while helping businesses save money and invest in their own people, not vendors’ people.

So, my team and I developed a pricing structure where, by paying $100, around 85% goes to developers as salary. How is it possible, you’d ask. It’s simple – we don’t charge any add-ons. There is only a service fee, which we negotiate and fix in the contract, and a developer’s monthly salary. That’s it. If our clients need anything additional, they pay only when they actually use the service; no prepayments are needed. Plus, we handle all operations in-house, so we don’t apply markups for juggling third parties.”

Nadiia: “You also mention volume discounts on your website. Can you explain what it's all about?”

Dmytro: “Absolutely. So, our solution isn’t just about hiring developers and managing admin. It’s about supporting our clients' growth. That’s how my team and I came up with volume discounts. This is the percentage we offer our clients as their development teams grow. The larger the development team, the larger the discount they receive. This is our way of showing that we value our partnership and are invested in our clients' ongoing success.”

Nadiia: “I think this ties into the next topic I’d like to bring up: your website moving from alcor-bpo.com to alcor.com. What was the reasoning behind that decision?”

Dmytro: “When I founded Alcor in 2017, the term Business Process Outsourcing (BPO) reflected our goal: to handle non-core business operations so tech companies could focus on software development. But times change.

Even though BPO remains relevant, we at Alcor have outgrown this concept. We aren’t a call center or a process-outsourcing vendor. We are about progress and strategic growth.

At Alcor, our mission is to empower innovation by giving companies access to Valley-caliber tech talent in Eastern Europe and Latin America as simply as possible. We help VC-backed startups, scale-ups, and SMBs build and scale software engineering teams to solve global challenges.

For instance, we helped BigCommerce, a US-based e-commerce SaaS platform, build an 80-dev R&D center in just 12 months, which later powered its 2020 IPO. Another case is Dotmatics, a US scientific software company, for which we built a fully EOR-covered team of 30+ Valley-caliber talent, which contributed to their acquisition by Siemens last year.

And that’s why we call ourselves a Tech R&D Center Accelerator. We launch and scale software development teams from 10 to 100 engineers in a year, enabling our clients to build new products and secure investment faster.”

Nadiia: “That sounds very inspiring. I’m also curious about the locations where you help tech companies expand. I think you’ve mentioned Ukraine.”

Dmyrto: “Right, so Alcor was born in Ukraine, and initially, we focused exclusively on our local tech market. Then, in 2022, we expanded our presence across Eastern Europe to Poland, Romania, and Bulgaria. And about a year later, we also entered Latin America, focusing on Mexico, Colombia, Argentina, and Chile.

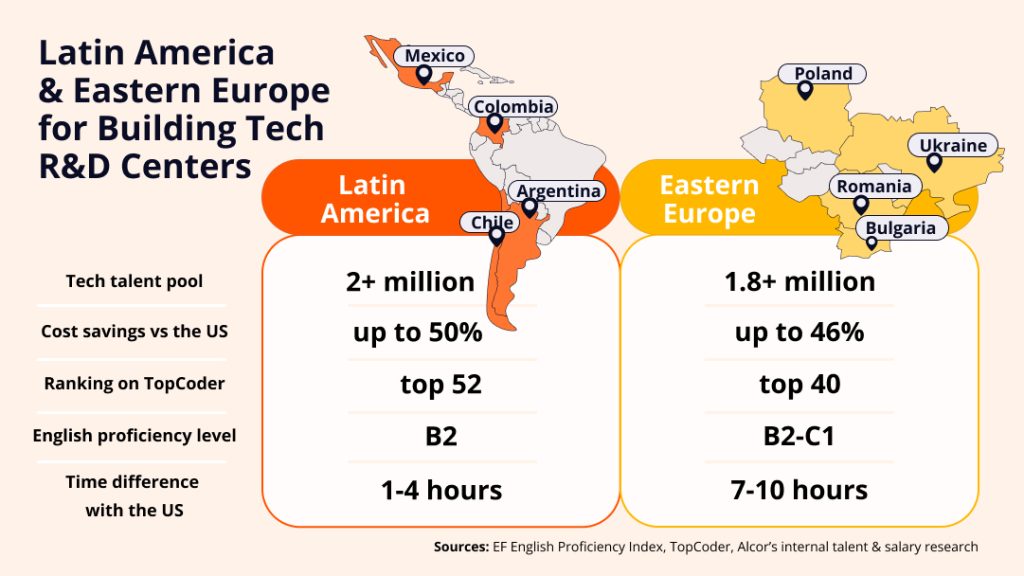

The choice of these locations wasn’t random. Eastern Europe has long been a powerhouse of exceptional programmers, ranking in the top 40 globally for technology skills and boasting advanced English proficiency. Latin America caught our attention because of its rapidly growing tech talent pool, which now exceeds 2 million developers, tech salaries that are 50% lower than in the US, and, of course, its proximity to North America in time zones.”

*We collected the stats cited by Dmytro in this interview from trusted sources.

Nadiia: “I’ve been recruiting developers in LATAM for several years, and I definitely agree that it’s currently a hotspot for tech, especially Mexico, with its 800K talent pool. And in the broader context of locations, is Ukraine still on the radar of expanding tech companies?”

Dmytro: “I notice two types of mindsets among tech executives who consider Ukraine for tech business. There are those who see obstacles, and they hold back from expanding here because of the uncertainty. And those who see opportunities and understand the potential of Ukrainian tech, willing to make a long-term bet that will pay off in innovation, ROI, and success.

Over almost four years of russia’s full-scale invasion, we’ve seen both scenarios play out. Yes, some companies shifted operations abroad or paused activities due to risks. But many others entered Ukraine or even doubled down on it, recognizing its resilient engineers who can deliver top results despite power outages and missile attacks.

And it’s actually proven by figures. For instance, last year, Ukrainian tech generated almost $6 billion in IT exports and accounted for nearly 4% of the country’s GDP. This is quite impressive, considering the wartime conditions.

And part of this resilience is my team, 70% of whom are Ukrainians, and working beside them is one of the greatest privileges of my career. We’ve made a conscious choice as a company to stand with Ukraine, not only emotionally, but in business, as we don’t work with russian companies or anyone who supports the aggressor. Plus, since the beginning of the war, we’ve been donating to the Ukrainian army.”

Nadiia: “Huge respect to you and the Alcor team for making such an impactful contribution. Now, looking ahead – what’s your vision for the future of the Ukrainian and global IT industries? And what’s waiting for the software R&D center niche?”

Dmytro: “From what I see, the demand for skilled tech experts continues to grow globally. Many tech leaders struggle to find the talent they need, especially in sectors like AI, cybersecurity, robotics, and cloud computing. At the same time, hiring costs continue to climb, which is most evident in highly competitive markets like the US, where salaries for in-demand senior engineers exceed $170K per year.

This means more tech leaders will seek opportunities abroad and choose strategic expansion models. From what I remember, about 8 in 10 organizations are leveraging global in-house centers, in other words, R&D centers, which enable them to keep knowledge in-house while reducing costs.

So, I’d say that, firstly, Ukraine, Eastern Europe, and LATAM in general, will remain the go-to tech markets for building software development teams. The focus will just shift from outsourcing to a product-centric approach.

And secondly, R&D centers will gain more traction. From delivery units, they’ll transform into strategic innovation engines for expanding tech companies seeking to future-proof their business and build lasting competitive advantage.

Alcor, as a Tech R&D Center Accelerator, remains committed to helping foreign hi-tech companies realize their staffing and strategic goals across LATAM and Eastern Europe through long-term partnerships.”

Nadiia: “That’s an incredibly powerful vision. Dmytro, thank you for sharing your story, your business model, and your perspective. I’m sure our audience will walk away seeing global tech expansion in a completely new light.”

Dmytro: “Thanks for having me, and wishing everyone peace and a prosperous 2026 business year.”